Market Report: Q2 2024 Analysis of Small Business Transactions

Introduction

The second quarter of 2024 showcased significant activity in the small business transaction market, reflecting various trends and economic conditions that have shaped buyer and seller behaviors.

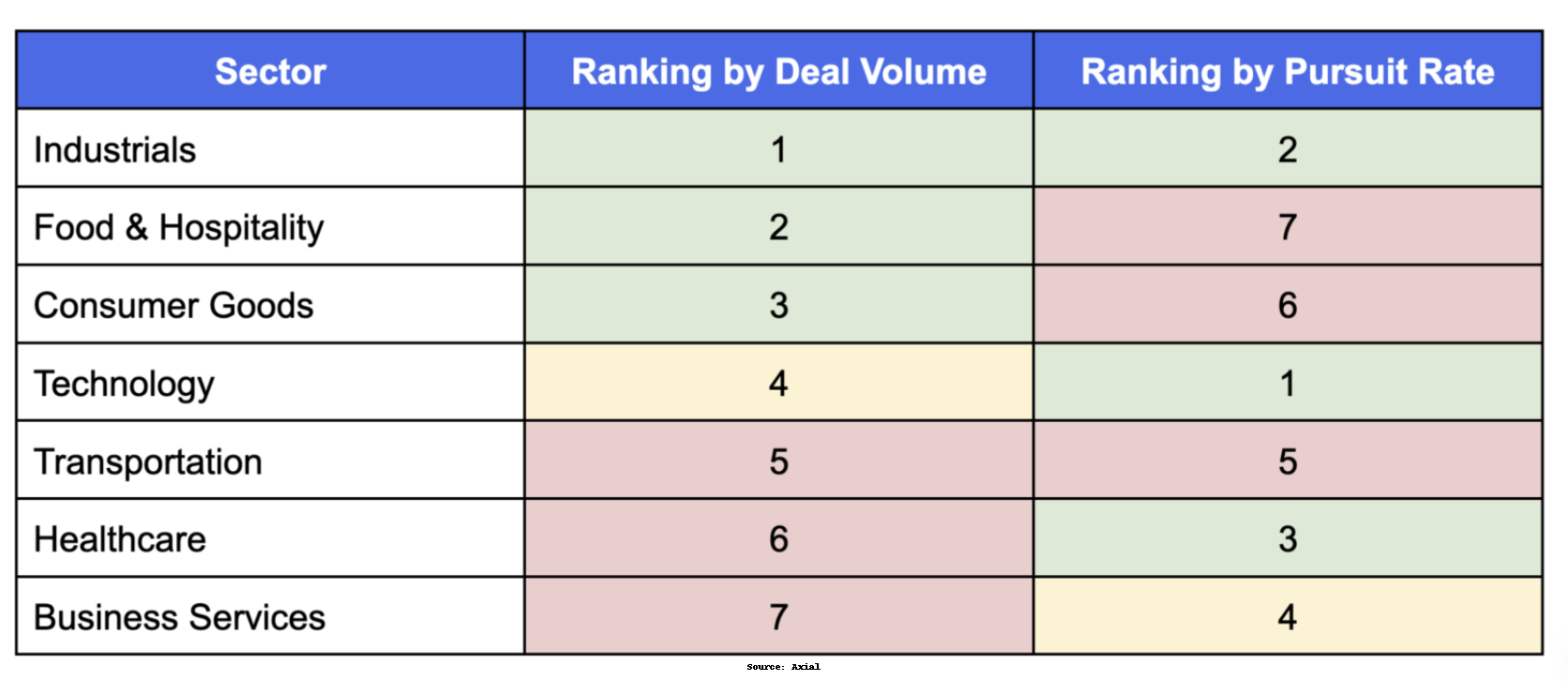

Overall, market activity remained robust in the second quarter. According to Axial’s report, there were 2,574 deals brought to market, marking a slight decrease of 2.83% compared to the same period last year. Notably, the Technology sector led in pursuit rates, indicating a high level of initial interest from buyers. Meanwhile, Business Services and Industrials were the only sectors to see year-over-year increases in deal flow.

BizBuySell’s report presented a similarly active market, with 2,448 businesses reported sold in the second quarter. This represents a 5% increase from the second quarter of 2023.

Sector-Specific Trends

In the Technology sector, pursuit rates were notably high despite the sector ranking fourth in deal volume per Axial. This suggests that buyers are particularly interested in technological businesses, potentially due to their perceived growth potential and importance in a digital economy.

The Healthcare sector exhibited high pursuit rates, ranking third despite being sixth in deal volume from Axial. This reflects strong buyer interest in healthcare businesses, likely due to their essential nature and steady demand.

From the BizBuySell insights, the service sector showed a 17% increase in median sale prices, supported by strong margins and stable revenues. Manufacturing businesses saw even more significant gains, with a 31% rise in median sale prices and notable increases in both cash flow and revenue. On the other hand, the retail sector experienced a slowdown, with median sale prices decreasing by 4%. The restaurant sector remained flat year-over-year in transactions, with a 6% drop in median sale prices.

Buyer and Seller Dynamics

Buyer preferences in the second quarter were clearly focused on financial performance and stability. Forty-two percent of buyers surveyed by BizBuySell prioritized financial performance, followed by growth potential at 26% and location at 15%. Stability was highly valued, with 69% of buyers preferring recession-resistant businesses, reflecting a cautious approach amidst economic uncertainties.

Sellers, on the other hand, adapted their strategies to meet the demands of a high-interest-rate environment. Flexible deal structures, such as offering financing and earnouts, became more common. The proportion of owners open to seller financing increased from 21% last year to 24% this year per BizBuySell, demonstrating a willingness to accommodate buyers.

Market Outlook

Looking ahead to the second half of 2024, the business-for-sale market is expected to grow modestly. With potential interest rate cuts on the horizon, conditions may become even more favorable for transactions. This presents an opportune time for sellers to exit their businesses, given the strong demand and stable prices.

Long-term projections suggest that 2025 will be a robust year for transactions, driven by aging baby boomers and owner burnout. This environment will likely offer opportunities for realistic valuations and favorable deal structures.

Conclusion

The small business transaction market in Q2 2024 demonstrated resilience and adaptability, with significant buyer interest and strategic seller accommodations shaping a dynamic environment. As economic conditions evolve and political factors play out, the market is poised for continued activity and growth, offering promising opportunities for both buyers and sellers.

.